A job description is a human resources instrument that explains the who, what, when, where, why, and how of a job. Find out how having a good job description helps potential employees find the right role and provides employers with qualified potential candidates based on skills or experience, helping to streamline the hiring process.

A good job description is an excellent opportunity to introduce potential employees to the company’s culture. Job analysts must develop descriptions that set the tone for a mutually beneficial employer-employee relationship. It is often the first impression that a potential employee has of the company and could be the deciding factor for candidates wanting to apply for the role.

The hiring process can be challenging for all involved. Writing a job description may seem tedious, but in the end, job descriptions can be applied to several human resources activities and save HR departments and recruiters valuable sourcing and hiring time. Download ERI's white paper to learn how to write an accurate and useful job description.

…ERI is a tremendous resource for wage analysis, cost of living, cost of labor, and relocation data for our employees… I have examined other tools offered by your competitors and I have found that I have complete confidence in ERI’s methodology, and, with that confidence, I am able to present data to my upper management, which they also have confidence in as well.

ERI Economic Research Institute was founded over 35 years ago to provide trusted compensation data for private and public organizations. ERI has established itself as a gold standard for global salary benchmarking and geographic differentials and has evolved to offer a complete compensation management software solution.

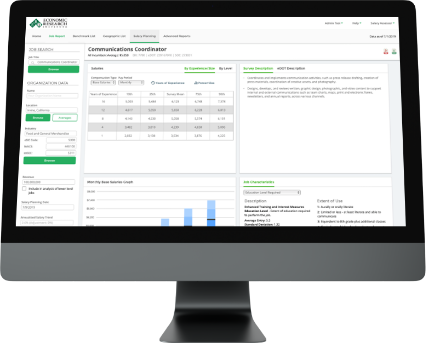

ERI compiles the comprehensive salary, cost-of-living, and executive compensation survey data, complete with real-time, global market data. ERI combines its state-of-the-art data with advanced compensation management solutions, empowering organizations with control and oversight of their workforce. Data are analyzed using both cutting-edge AI methods and traditional statistics, with analytical methods tailored to the scenario.

Data are gathered from 3 sources: surveys we conduct, surveys purchased from other organizations, and reports from publicly traded organizations.

After compiling the data, we conduct QA to ensure data are of the highest quality.

ERI conducts advanced analytics to accurately capture the full scope of an occupation and how it exists in the economy.

ERI analysts double-check the results for each job every quarter.

Explore ERI’s wage, salary, and compensation databases of over 11,000 job titles, 1,000 industries, and 9,000 locations.

ERI has an extensive talent pool, with specialties in areas such as statistics, mathematics, software development, and global total rewards management, to design and provide best-in-class interactive software, updated frequently, with consensus results from the most reliable survey sources.

ERI maintains several databases, tracking wage and salary information (as well as cost of living information) for the United States, Canada, the United Kingdom, Europe, and other countries around the world. Data for each country is maintained separately.

ERI's Assessor Series® captures and combines the strengths of the Internet and over 35 years of research to provide instantaneous answers to your most pressing compensation questions.

ERI's goal is to be your organization's compensation research outsource. You can duplicate ERI's calculations if you want to spend the time and resources required to collect, compile, and analyze the thousands of data points that comprise any one city's wage and salary rates, as well as cost of living levels. However, subscribers can now spend this time and these resources administering pay and performing the many other duties demanded by today's Human Resource positions.

ERI researchers save you time and money!

ERI's research analysts know of no other single source that offers both wage/salary information and cost of living information.

For cost of living data, due to the continued use of data collection techniques of the 1940s, our competitors have to charge more for one report than ERI charges for an annual subscription to the Relocation Assessor® software and databases. ERI collects cost of living data more efficiently and inexpensively, and passes those savings on to subscribers.

For salary and wage data, you could purchase individual survey sources and conduct an in-house analysis of those sources, or you could purchase compiled wage data from a third-party supplier via a hardcopy report or Internet download. However, ERI offers advantages over both these options.

Purchasing one of our competitors' surveys is almost always more expensive; one survey can cost as much as an annual subscription to an Assessor Series application that allows for an unlimited number of analyses. Our competitors' individual surveys profile only a fraction of the data available for any given position or area, and they report neither the large number of job titles included in ERI's databases, nor adjustments for the number of industries and areas available to Assessor Series subscribers.

Purchasing compiled wage data from a third-party supplier also has its drawbacks. Quite often these third-party suppliers require an annual or multi-year contract. ERI's Assessor Series offers the advantages of more wage data and more features at a fraction of the cost.

As a research firm (engaged in research, not marketing/sales), ERI has been collecting and analyzing data from thousands of salary surveys for over 35 years. Most of the third-party suppliers on the Internet have only been in business for a few years. ERI's new executive compensation survey is the largest compensation survey in history.

ERI's approach to evaluating survey data for validity, as well as the analyses we use to compile data, also differ from our competitors. ERI utilizes a completely different set of position titles, position descriptions, geographic areas, industries, and even types of company/organization size when compared to other companies. The detailed way in which we report data varies greatly from our competitors.

ERI's Assessor Series offers many advantages when compared to third-party compilers of wage data.

ERI provides the following:

- Information on survey sources, standard error, and survey population job code information for each position, as well as job code/industry crosswalks

- Data for more than 39,600 position titles in more than 10,500 geographic areas, including the United States, Canada, the United Kingdom, Europe, and other countries around the world

- Survey description briefs (one-paragraph summaries) and detailed position descriptions based on the format of the original Dictionary of Occupational Titles (DOT)

- Interactive software that permits the selection of specific peer comparables for competitive analysis

Furthermore, ERI recognizes the greater complexities involved in determining executive compensation vs. non-executive compensation, and provides the added benefit of quickly downloading full proxies and 10-Ks for comparable companies (for greater defensibility and illustration of identifiable practices).

Wage and salary differentials reflect the local demand for and supply of labor.

Cost of living is dictated by the local demand for and supply of goods and services. Local wages and salaries do not indicate the local cost of living. Cost of living indicates the comparable local buying power for any given salary.

The cost of living data that goes into ERI databases are downloaded from existing sources. This data includes: rental rates, income taxes, property taxes, gasoline prices, medical costs/services, major retail grocery and drug store prices, etc. Cost of living differentials, as reported by ERI, reflect cost models at different income levels (e.g., an auto of "x" value driven "y" miles/kilometers, home rental with no mortgage income tax deductions, home ownership with income tax mortgage deductions in North America, etc.).

Most compensation professionals agree that when a company is hiring from the local work force (that is, when no transfer or relocation occurs), wages and salaries should be set according to market pricing of wages and salaries only. In general, branch pay should be dictated by market pricing of wage/salary differentials only.

While employees may find it more desirable for their pay to be adjusted for local cost of living variances, this is an unusual practice. In many cases, this practice is not cost effective for the employer. That is, in many cases the employer would be competing against organizations with relatively lower compensation costs, and thus, be at a competitive disadvantage.

In most cases, cost of living is considered only when an employee incurs new expenses due to an "internal" move, from one branch office to another. In this situation, the new salary would be set according to the destination market (local wage and salary level). Then, any cost of living allowance would be awarded separately from salary and for a finite period of time.

It is undesirable to build a cost of living adjustment into salary, as the integrity of the current salary administration program will be compromised. For instance, the transfer of personnel into an office where locally hired employees are earning lower salaries than the transferee's "cost of living adjusted salary" is an undesirable and avoidable situation. The transfer of personnel into an area where local competitors' employees are earning higher salaries than the transferee's "cost of living adjusted salary" is an equally undesirable and avoidable situation. Better solutions would include the award of a one-time (lump sum) moving bonus, or a gradually decreasing three-year cost of living allowance that is awarded separately from the new locally adjusted competitive salary. Each organization's unique situation (tax considerations, cash-flow, etc.) will dictate the best method for handling cost of living allowances.

A random telephone survey by ERI's Director found that only 2% of ERI subscribers pay "the same for all jobs nationally, but vary levels by the cost of living." All other surveyed subscribers stated that they ignore cost of living and concentrate on supply and demand/local market pricing to administer geographic pay differentials.

A number of voluntary subscriber disclosures about reliance on ERI data are cited in customer testimonials and corporate proxies and periodically appear in other authorized releases or public declarations. ERI does not release listings of the names of its subscribers.

A complete listing or count of all users for over 35 years would be problematic since users might not reveal their identities to ERI, entities change names, and current subscriber populations are constantly increasing. In general, ERI's research database subscriptions are available to management, analysts and consultants and are now widely used by client organizations (thousands of corporate and consulting subscribers).

Subscribers include corporate compensation, relocation, human resources, and other professionals, as well as independent consultants and counselors, and US and Canadian public sector administrators (including military, law enforcement, city/county, state/provincial, and federal government pay administrators). With the introduction of the Occupational Assessor (eDOT), vocational rehabilitation counselors, forensic economists, immigration attorneys and a host of other niche professionals are now joining as subscribers.

For those interested in nonprofits, the Nonprofit Comparables Assessor (CA) is the definitive and comprehensive census of nonprofit executive pay used by charities, foundations, and their consultants. ERI analyses are not available to the general public.

ERI only reports rates from surveys. Internships, being typically temporary or seasonal work, tend not to be covered by surveys of competitive pay because their rates are set internally, usually at levels just below the lowest level for the full-time equivalent jobs they fit.

ERI recommends you pay interns around the 10th or 15th percentiles for first-year incumbents of the positions they fill. This assures these trainees do not make more than current full-time incumbents of comparable jobs.

Another option is to compare notes with other local employers in your industry, because intern rates tend to be extremely localized and customized to specific industries. Trading with rivals will assure that interns are paid comparably across organizations.

You can be using the software in just a few minutes. A credit card purchase permits immediate access to the dataset. If you prefer to pay from an invoice or by check, please call our Subscriber Services at 800.627.3697 (US/Canada).

2026 © ERI Economic Research Institute, Inc. ALL Rights Reserved.